Now - we'll broaden

the isolated poor

Jersey Joe's POV wider —

as we camp HuffPoCo

At a time when our political and financial landscapes are littered with villains and those unwilling to take them on, it's refreshing to find someone in the halls of power that we can unabashedly celebrate.

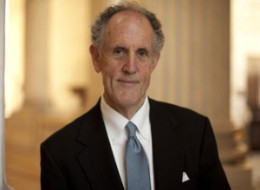

Enter Sen. Ted Kaufman of Delaware. Kaufman, Joe Biden's longtime chief of staff who was appointed to serve out his old boss's term, was originally thought to be a Senate placeholder.

But, far from biding his time, Kaufman has emerged as one of the Senate's fiercest critics of Wall Street and a champion of the need to push for a serious rebooting of our financial system.

When I met with Kaufman earlier today in his small, basement "hideaway" in the Capitol ("it took Sen. Biden 15 years to get one of these; I was lucky to get one right away"), the first thing I wanted to know was what had inspired his transformation from behind-the-scenes staffer to fire-breathing accidental leader. Was there a Road to Damascus moment?

"In the beginning," he told me, "though I was very upset about what had happened on Wall Street, it wasn't one of my key objectives. In fact, the committees I got on were Foreign Affairs and Judiciary. But then I started reading more and more about the way the SEC was failing to curb abusive practices when it came to short selling. So I started speaking out on that... and the blogosphere really got involved, reporting what I was saying. Then people started reaching out to me: 'You think this is bad about short selling, you ought to take a look at this'... or 'you ought to take a look at that!' So we started getting all this information, and then checking it out with academics, folks from the industry, we just started building this whole repository of things that were still going on as if nothing bad had ever happened."

Kaufman, who turned 71 on Monday, has a very unusual resume for a senator. He earned an engineering degree from Duke, followed by an MBA from Wharton. He then worked at DuPont before shifting his focus to government, working as Biden's chief of staff from 1976 to 1995.

The first piece of financial reform legislation he cosponsored, along with Sens. Patrick Leahy and Chuck Grassley, gave federal prosecutors combating financial fraud more power. President Obama signed the bill into law last May.

Since then, Kaufman has immersed himself in the often byzantine battles over financial regulation -- and watched as financial reform has been watered-down and lobbied within an inch of its life.

Frustrated, Kaufman has moved to the forefront of those willing to stand up and demand real change. While far too many of his Senate colleagues tinker around the edges of our broken financial system, creating what Kaufman has derided as "compromise measures that give only the illusion of change and a false sense of accomplishment," Kaufman is fighting to create a financial infrastructure that will protect us from having another financial meltdown.

In the last week alone, Kaufman has taken to the Senate floor to deliver two major -- and blistering -- speeches. The first was a masterful overview, offering chapter and verse on what led to the financial crisis and what, specifically, needs to be done to ensure that we "build a regulatory system that will endure for generations instead of one that will be laid bare by an even bigger crisis in perhaps just a few years or a decade's time."

Kaufman quite simply wants to put an end to "too big to fail" banks: "We need to break up these institutions before they fail, not stand by with a plan waiting to catch them when they do fail."

He believes strongly in the need for a "Glass-Steagall for the 21st century," the need to radically clean up the over-the-counter derivatives market, the need to make the shadow banking world far more transparent, and the need to better address "the fundamental conflicts of interest on Wall Street" that lead to securities fraud. Kaufman, looking very Lincoln-esque with his long, thin face and lanky build, doesn't mince words.

"Individuals at Enron, Merrill Lynch, and Arthur Andersen were called to account for their participation in fraudulent activities," said Kaufman. "But it is quite possible that no one will be held to account, either in terms of criminal or civil penalties, due to the deception and misrepresentation manifest in our most recent credit cycle."

Monday, on his 71st birthday, Kaufman took to the Senate floor to lambast the loss of the rule of law on Wall Street -- his outrage sparked by the damning report from the bankruptcy examiner for Lehman Brothers.

He reminded his colleagues that the American taxpayer has laid out over $2.5 trillion to "save the system," and asked: "What exactly did we save?" His answer: "a system of overwhelming and concentrated financial power that has become dangerous... a system in which the rule of law has broken yet again."

After saying that he was "concerned that the revelations about Lehman Brothers are just the tip of the iceberg," he explained the overarching reason reform is essential:

"At the end of the day, this is a test of whether we have one justice system in this country or two. If we don't treat a Wall Street firm that defrauded investors of millions of dollars the same way we treat someone who stole $500 from a cash register, then how can we expect our citizens to have faith in the rule of law?... Our markets can only flourish when Americans again trust that they are fair, transparent, and accountable."

The great thing about Kaufman is that he isn't afraid to use direct, pointed language, saying that "fraud and lawlessness were key ingredients" in the financial collapse. And he's willing to name names: in his attack on derivatives, he called out Alan Greenspan, Robert Rubin, and Larry Summers as key cheerleaders for unregulated derivatives markets.

Contrast that with Tim Geithner who, during his interview with Rachel Maddow this week, not once, not twice, but three times ascribed the financial crisis to a "failure of government." One time it was "an outrageous failure of government." The next it was "a tragic failure of government." The third, it was "a terrible failure of government." But before it was failure of government -- i.e. of regulations -- wasn't it an outrageous, tragic, and terrible failure of Wall Street?

Spending time with Sen. Kaufman, and witnessing his passion and determination to fix the system, I asked myself: What conditions helped turn him into a fearless crusader? And how do we get more like him?

Leaving aside his personal character and wisdom, which we cannot duplicate, there is one very big condition we can: The absence of money as a factor in our leaders' decision making. Kaufman didn't need to raise any money to become a senator -- he was appointed. And he doesn't need to raise any money for his reelection campaign -- he's not running.

At 71, with a long, distinguished career in government under his belt, Kaufman is completely unencumbered by the need to curry favor and approach moneyed interests with his hat in his hand.

So let's all take a good look at Ted Kaufman. This is what it looks like when our representatives are not beholden to special interests, and are only serving the public interest.

HuffPoCo Reporting:

HuffPoCo Reporting:Shahien Nasiripour:

Senator Calls For

Aggressive Financial

Reform, Deplores

Current 'Incremental' Steps

In a Thursday morning speech on the Senate floor, Sen. Ted Kaufman (D-Del.) blasted the "incrementalism" approach to fixing the nation's broken financial system, laid bare by a financial crisis that wiped out trillions of dollars in wealth and sent the economy into a tailspin not seen since the Great Depression.

Rather than nibbling around the edges, Kaufman wants to impose strict limits on financial firms' activities; significantly cut them down in size; and wants Congress to act more forcefully because federal banking and securities regulators failed to protect the public from an increasingly dangerous financial industry.

The fact is, he intoned, "the government's response to the financial meltdown has only made the industry bigger, more concentrated and more complex."

Because of that, "[f]inancial regulatory reform is perhaps the most important legislation that the Congress will address for many years to come," said Kaufman, Vice President Joe Biden's replacement in the Senate. Otherwise, "if we don't get it right, the consequences of another financial meltdown could truly be devastating."

Simon Johnson, former chief economist of the International Monetary Fund, professor at the MIT Sloan School of Management and contributing editor to the Huffington Post, said it's "the speech for which we have been waiting."

Excerpts below...

Kaufman on the need for fundamental reform:

I start by asking a simple question: Given that deregulation caused the crisis, why don't we go back to the statutory and regulatory frameworks of the past that were proven successes in ensuring financial stability?...

Mind you, this is a financial crisis that necessitated a $2.5 trillion bailout. And that amount includes neither the many trillions of dollars more that were committed as guarantees for toxic debt nor the de facto bailout that banks received through the Federal Reserve's easing of monetary policy...Given the high costs of our policy and regulatory failures, as well as the reckless behavior on Wall Street, why should those of us who propose going back to the proven statutory and regulatory ideas of the past bear the burden of proof? The burden of proof should be upon those who would only tinker at the edges of our current system of financial regulation...

Congress needs to draw hard lines that provide fundamental systemic reforms, the very kind of protections we had under Glass-Steagall. We need to rebuild the wall between the government-guaranteed part of the financial system and those financial entities that remain free to take on greater risk...

The notion that the most recent crisis was a "once in a century" event is a fiction. Former Treasury Secretary Paulson, National Economic Council Chairman Larry Summers, and JP Morgan CEO Jamie Dimon all concede that financial crises occur every five years or so.

Kaufman on the growth of megabanks:

Most of the largest banks are products of serial mergers. For example, J.P. Morgan Chase is a product of J.P. Morgan, Chase Bank, Chemical Bank, Manufacturers Hanover, Banc One, Bear Stearns, and Washington Mutual. Meanwhile, Bank of America is an amalgam of that predecessor bank, Nation's Bank, Barnett Banks, Continental Illinois, MBNA, Fleet Bank, and finally Merrill Lynch.

Kaufman on the failure of regulators:

Regulatory neglect, however, permitted a good model to mutate and grow into a sad farce...In fact, one of the primary purposes behind the securitization market was to arbitrage bank capital standards. Banks that could show regulators that they could offload risks through asset securitizations or through guarantees on their assets in the form of derivatives called credit default swaps (CDS) received more favorable regulatory capital treatment, allowing them to build their balance sheets to more and more stratospheric levels.

While this was a recipe for disaster, it reflected in part the extent to which the and complexity of this new era of quantitative finance exceeded the regulators' own comprehension...

In the brief history I outlined earlier, the regulators sat idly by as our financial institutions bulked up on short-term debt to finance large inventories of collateralized debt obligations backed by subprime loans and leveraged loans that financed speculative buyouts in the corporate sector.

They could have sounded the alarm bells and restricted this behavior, but they did not. They could have raised capital requirements, but instead farmed out this function to credit rating agencies and the banks themselves. They could have imposed consumer-related protections sooner and to a greater degree, but they did not. The sad reality is that regulators had substantial powers, but chose to abdicate their responsibilities.

Kaufman on Too Big To Fail and the government's response during the crisis:

This provided them with permanent borrowing privileges at the Federal Reserve's discount window - without having to dispose of risky assets. In a sense, it was an official confirmation that they were covered by the government safety net because they were literally "too big to fail"...

We haven't seen such concentration of financial power since the days of Morgan, Rockefeller and Carnegie...By expanding the safety net -- as we did in response to the last crisis -- to cover ever larger and more complex institutions heavily engaged in speculative activities, I fear that we may be sowing the seeds for an even bigger crisis in only a few years or a decade...

Because of their implicit guarantee, "too big to fail" banks enjoy a major funding advantage - and leverage caps by themselves do not address that. Our biggest banks and financial institutions have to become significantly smaller if we are to make any progress at all.

Kaufman on current financial reform proposals:

Unfortunately, the current reform proposals focus more on reorganizing and consolidating our regulatory infrastructure, which does nothing to address the most basic issue in the banking industry: that we still have gigantic banks capable of causing the very financial shocks that they themselves cannot withstand...

While no doubt necessary, [resolution authority] is no panacea. No matter how well Congress crafts a resolution mechanism, there can never be an orderly wind-down, particularly during periods of serious stress, of a $2-trillion institution like Citigroup that had hundreds of billions of off-balance-sheet assets, relies heavily on wholesale funding, and has more than a toehold in over 100 countries.There is no cross-border resolution authority now, nor will there be for the foreseeable future...

Yet experts in the private sector and governments agree - national interests make any viable international agreement on how financial failures are resolved difficult to achieve. A resolution authority based on U.S. law will do precisely nothing to address this issue...

While I support having a systemic risk council and a consolidated bank regulator, these are necessary but not sufficient reforms - the President's Working Group on Financial Markets has actually played a role in the past similar to that of the proposed council, but to no discernible effect. I do not see how these proposals alone will address the key issue of "too big to fail."

Kaufman on separating Main Street banking from Wall Street trading:

Massive institutions that combine traditional commercial banking and investment banking are rife with conflicts and are too large and complex to be effectively managed...To those who say "repealing Glass-Steagall did not cause the crisis, that it began at Bear Stearns, Lehman Brothers and AIG," I say that the large commercial banks were engaged in exactly the same behavior as Bear Stearns, Lehman and AIG - and would have collapsed had the federal government not stepped in and taken extraordinary measures...

By statutorily splitting apart massive financial institutions that house both banking and securities operations, we will both cut these firms down to more reasonable and manageable s and rightfully limit the safety net only to traditional banks. President of the Federal Reserve Bank of Dallas Richard Fisher recently stated: "I think the disagreeable but sound thing to do regarding institutions that are ['too big to fail'] is to dismantle them over time into institutions that can be prudently managed and regulated across borders. And this should be done before the next financial crisis, because it surely cannot be done in the middle of a crisis."

A growing number of people are calling for this change. They include former FDIC Chairman Bill Isaac, former Citigroup Chairman John Reed, famed investor George Soros, Nobel-Prize-winning-economist Joseph Stiglitz, President of the Federal Reserve Bank of Kansas City Thomas Hoenig, and Bank of England Governor Mervyn King, among others. A chastened Alan Greenspan also adds to that chorus, noting: "If they're too big to fail, they're too big. In 1911 we broke up Standard Oil -- so what happened? The individual parts became more valuable than the whole. Maybe that's what we need to do."

WATCH Kaufman discuss derivatives:

Watch Kaufman discussing Greenspan and Too Big To Fail:

If the video fails - go to the source. Mea Culpa.

Related News On Huffington Post:

| ||

| ||

| ||

|

Democrats are charging that the GOP made up a fake messaging memo that purports to be from Democrats as a way to undermine the party's message at the last minute. The memo was circulated to reporters -- including this one -- by a spokesman to House Minority Leader John Boehner. Politico reported on the memo and posted a story which the Drudge Report featured prominently.

"The memo is a fake," said Kristie Greco, a spokesperson for Majority Whip James Clyburn (D-S.C.). "It's an under-handed and unethical attempt to distract from the health care debate. If opponents of health insurance reform had a credible policy alternative they wouldn't have to resort to nefarious games."

Several anonymous Democratic aides similarly told Talking Points Memo's Christina Bellantoni that the memo was a trick:

"We have checked with every Democratic office, no one has ever seen it. It did not come out of a Democratic office," the aide said, adding that media outlets printing the memo have not checked with leadership offices if the memo is authentic. A second Democratic leadership aide confirmed the memo was not sent by the Democrats. A third Democratic aide also said the memo is fake, citing the "draft" stamp and saying no one uses such things.

"If this were a Democratic communications person who wrote this, they should be fired, because this looks like Republican talking points," the third Democratic aide told TPMDC.

Politico has since pulled the memo, leaving Drudge to link instead to a page that reads "UPDATE: Democrats challenge authenticity of 'doc fix' memo."

The right-wing blog Big Government, however, still has it up as evidence that Democrats intend to mislead the American people about the cost of the bill.

"The facts remain the same. If Democratic leadership is going to do the doc fix bill, then they're low-balling the cost of the bill by $330 billion. If they're not, why is the AMA endorsing it?" said Boehner's spokesman Michael Steel.

UPDATE 3/19 5:20pm: Rep. Scott Garrett (R-N.J.) just read from the memo on the House floor. And Rep. Anthony Weiner (D-N.Y.) responded by ripping him and demanding his source.

"What they're doing is producing fake memos," he said.

"That memo that he read from has no source. He will not return to the microphone to tell us what it was because he took something that was created by the opponents of health care -- and there are a whole lot of them, mostly paid for by the health insurance industry -- and came to the rostrum with a fake document," said Weiner.

Rep. Virginia Foxx (R-N.C.) interrupted. "Parliamentary inquiry," she yelled.

"I don't yield for that," said Weiner, continuing. "There is no reluctance to talk about the real CBO score: $1.2 trillion in savings for the American people. That's the fact. That's nothing we're hiding from."

"Will the gentleman yield?"

"I will yield only if the person will tell us the source of the document."

A chaotic back-and-forth broke out until Weiner regained the floor.

"Ladies and gentlemen, what you saw just now is a microcosm for this debate: A real piece of legislation that for a year we've been working on and a fake document that they won't even give a source for," he said.

Excerpts from the memo:

-- Do not allow yourself (or your boss) to get into a discussion of the details of CBO scores and textual narrative....

-- anti-reform extremists are making a last-ditch effort to derail reform. Do not give them ground by debating details... Again, instead focus only on the deficit reduction and number of Americans covered. In the critical remaining hours of the debate we must drive the narrative of "health reform is deficit reduction." ...-- most health staff are already aware that our legislation does not contain a "doc fix"... The inclusion of a full SGR repeal [doc fix] would undermine reform's budget neutrality. So, again, do not allow yourself (or your boss) to get into a discussion of the details of CBO scores and textual narrative. Instead, focus only n the deficit reduction and number of Americans covered."

Here is the full memo:

DocFixMemo

Rep. Mike Honda:

Rep. Mike Honda:15th Congressional

District of California

in the U.S. House

Senator Graham's

Inappropriate

"Kamikaze"

Remarks on

Pelosi's Health

Care Efforts

This week, Senator Lindsey Graham made comments about Speaker Pelosi's efforts to galvanize support for health care reform, stating that she has Democratic Members "liquored up on sake" to make a "suicide run" to pass reform. Later he added, "I don't know whether it's sake or moonshine but no sober person would do this."

WILD ASSHAT?

For the Senator to add "moonshiners" to an already unsavory sake and suicide statement, does a disservice to the underlying issue. Citing that "no sober person would do [healthcare reform]", because Americans "do not need to lose their choice in health care", I question who has, in fact - to use the Senator's words - "lost their political mind". This "lose of choice" is exactly what this bill prevents by putting the healthcare industry in its place and by returning control to the American people. If the Senator has problems with us capping premiums or covering preexisting conditions, then I suggest he come clean on his addiction to the habits of the healthcare industry.

As a Japanese American who was interned along with my family during World War II, I am personally disheartened that Senator Graham chose to use racially tinged rhetoric to express his opposition to health care reform. There is a way to engage in healthy debate without ostracizing the 16.2 million AAPIs in this country, who are an important part of this democracy and health care reform. Many face barriers to quality health care, such as the high cost of health care, racial and ethnic health disparities, cultural isolation, and language barriers, to name a few.

We must pass health care legislation now, and we must show respect for our fellow Americans as we do so. This bill is an important starting point for efforts to improve quality of health care, increase access to health care for more Americans, lower costs for working families, and protect small businesses. I am also proud that it includes provisions that begin to address the racial and ethnic disparities that so many vulnerable communities face.

This is no drunken "kamikaze" mission, but a thoughtful and essential one that will serve all working families in this country, and return control from the health insurance companies to the American people.

I join Speaker Pelosi and call upon my colleagues in the U.S. Congress to send this critical health care legislation to President Obama's desk this week.

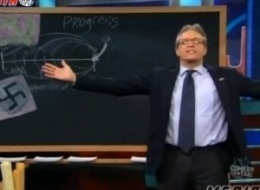

Rep Mike Honda is Chair of the Congressional Asian Pacific American Caucus.Jon Stewart's Spends

Half His Show

Skewering Glenn Beck

Words don't really do it justice, unless they're on a chalkboard, so just enjoy the video ...

INTRO:

Sparky says over and out!

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home